Welcome to Spiritual Products | Astrology Remedies Store

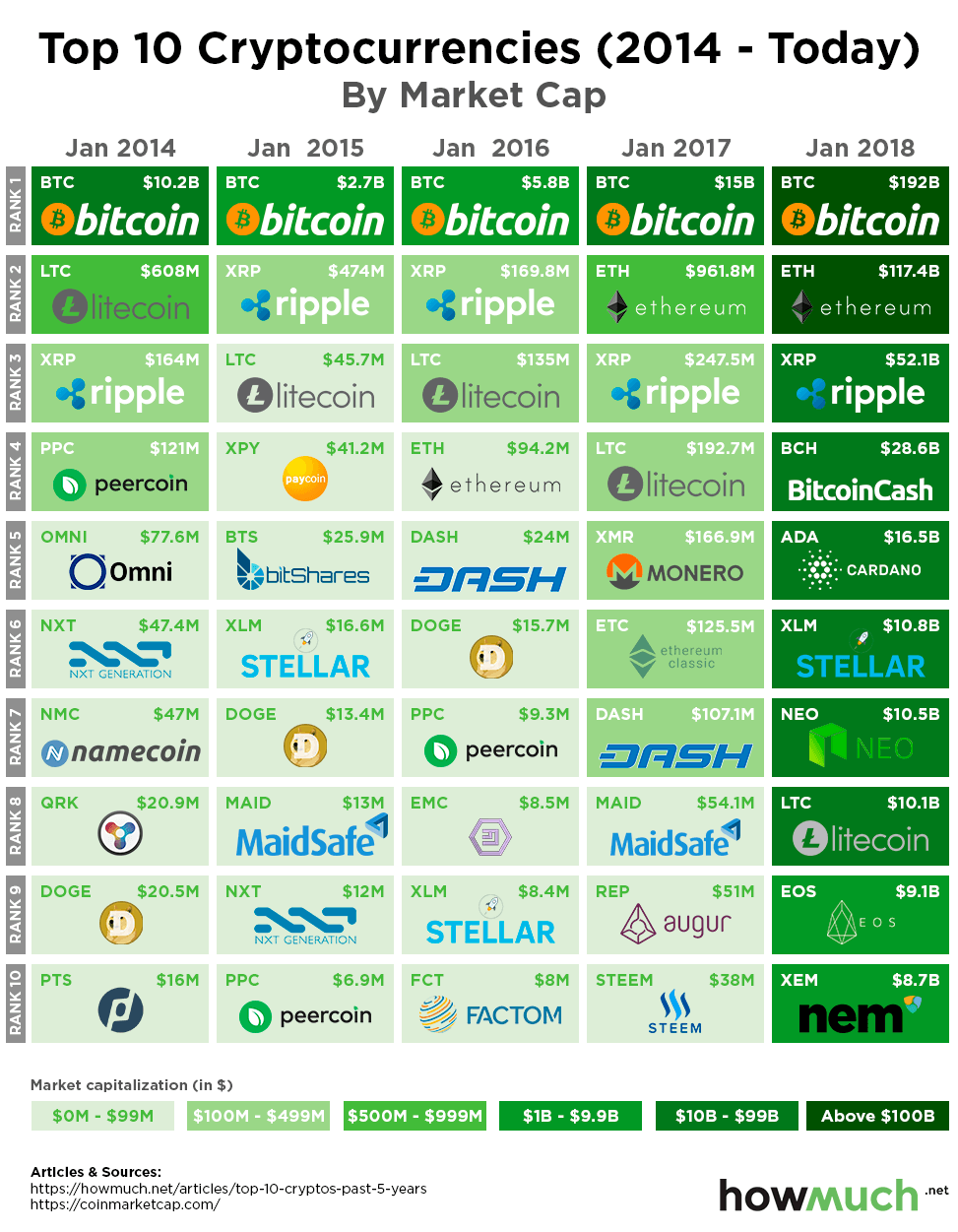

what is the market cap of all cryptocurrencies

What is the market cap of all cryptocurrencies

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency https://ippwatch.info/. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

The total crypto market volume over the last 24 hours is $172.65B, which makes a 34.94% increase. The total volume in DeFi is currently $27.22B, 15.77% of the total crypto market 24-hour volume. The volume of all stable coins is now $161.34B, which is 93.45% of the total crypto market 24-hour volume.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

All casinos accepting cryptocurrencies

Way back in the ancient times of 1983, when most of us were playing Super Mario Bros or listening to Bowie, a man by the name of David Chaum already conceptualized the first-ever crypto, which went by the name “eCash”. The system he described shares many similarities with the cryptos of today, including using electronic, randomly generated encryption keys to provide extra security and conceal the details of the transaction from banks and other institutions.

Known for its speed and low transaction fees, Litecoin is a practical option for players who want quicker deposits and withdrawals. It’s often referred to as the “silver to Bitcoin’s gold,” and is supported by many crypto casinos looking to offer more affordable gaming options.

Players at both traditional online casino sites and Bitcoin casino sites always want to know that they are playing at a trustworthy casino. Bitcoin casinos have a tool known as Provably Fair, which is an algorithm that checks and verifies Bitcoin casino’s fairness towards its players.

Way back in the ancient times of 1983, when most of us were playing Super Mario Bros or listening to Bowie, a man by the name of David Chaum already conceptualized the first-ever crypto, which went by the name “eCash”. The system he described shares many similarities with the cryptos of today, including using electronic, randomly generated encryption keys to provide extra security and conceal the details of the transaction from banks and other institutions.

Known for its speed and low transaction fees, Litecoin is a practical option for players who want quicker deposits and withdrawals. It’s often referred to as the “silver to Bitcoin’s gold,” and is supported by many crypto casinos looking to offer more affordable gaming options.

Why do all cryptocurrencies rise and fall together

Inflation and interest rates directly impact cryptocurrency prices. When inflation rises, traditional currencies lose value, prompting investors to seek alternative assets like Bitcoin. However, the relationship isn’t always straightforward. For example, Bitcoin’s price reacts differently depending on inflation levels:

Competition among cryptocurrencies drives innovation, reshaping the market landscape. Ethereum’s layer-2 scaling solutions have boosted transaction volumes, while tokenization of traditional assets has opened new markets. These advancements attract institutional investors, increasing liquidity and driving price growth.

Forks can also lead to uncertainty. When a blockchain splits into two versions, investors may hesitate, unsure of which version will gain traction. Bitcoin Cash, created from a bitcoin fork in 2017, saw initial volatility before stabilizing. Upcoming upgrades, like the Chang Hard Fork expected in 2024, are predicted to spark bullish trends based on historical patterns. These events demonstrate how technological changes can influence cryptocurrency prices both positively and negatively.

Similarly, if investors consider the investment too risky, they may pull out and reduce the demand, causing a drop in value. If you’ve ever asked yourself, “Why is the crypto market down this summer,” it is primarily due to external circumstances like gas prices and inflation causing investors to pull out.