Welcome to Spiritual Products | Astrology Remedies Store

cfd trading account

Cfd trading account

All traders – even the very best ones – make the wrong calls and lose money sometimes. The key is to have a risk strategy in place that cuts losses quickly. Then, if you maximise profit from your good trades, you can become profitable over time Versus Trade.

This website is not directed at UK residents and falls outside the European and MiFID II regulatory framework, as well as the rules, guidance and protections set out in the UK Financial Conduct Authority Handbook.

The www.markets.com/za/ site is operated by Markets South Africa (Pty) Ltd which is a regulated by the FSCA under license no. 46860 and licensed to operate as an Over The Counter Derivatives Provider (ODP) in terms of the Financial Markets Act no.19 of 2012. Markets South Africa (Pty) Ltd is located at BOUNDARY PLACE 18 RIVONIA ROAD, ILLOVO SANDTON, JOHANNESBURG, GAUTENG, 2196, South Africa. High Risk Investment Warning: Trading Foreign Exchange (Forex) and Contracts For Difference (CFDs) is highly speculative, carries a high level of risk and is not appropriate for every investor. You may sustain a loss of some or all of your invested capital, therefore, you should not speculate with capital that you cannot afford to lose. You should be aware of all the risks associated with trading on margin. Please read the full Risk Disclosure Statement which gives you a more detailed explanation of the risks involved.

CFDs are allowed in several countries with listed OTC markets. They include Belgium, Canada, Denmark, France, Germany, Italy, the Netherlands, New Zealand, Norway, Singapore, South Africa, Spain, Sweden, Switzerland, Thailand, and the United Kingdom.

What is cfd trading

When holding long positions overnight, traders typically pay financing charges. These fees represent the cost of the leverage provided by the broker—essentially, the interest on the “borrowed” capital used to control a larger position. The calculation usually follows this formula:

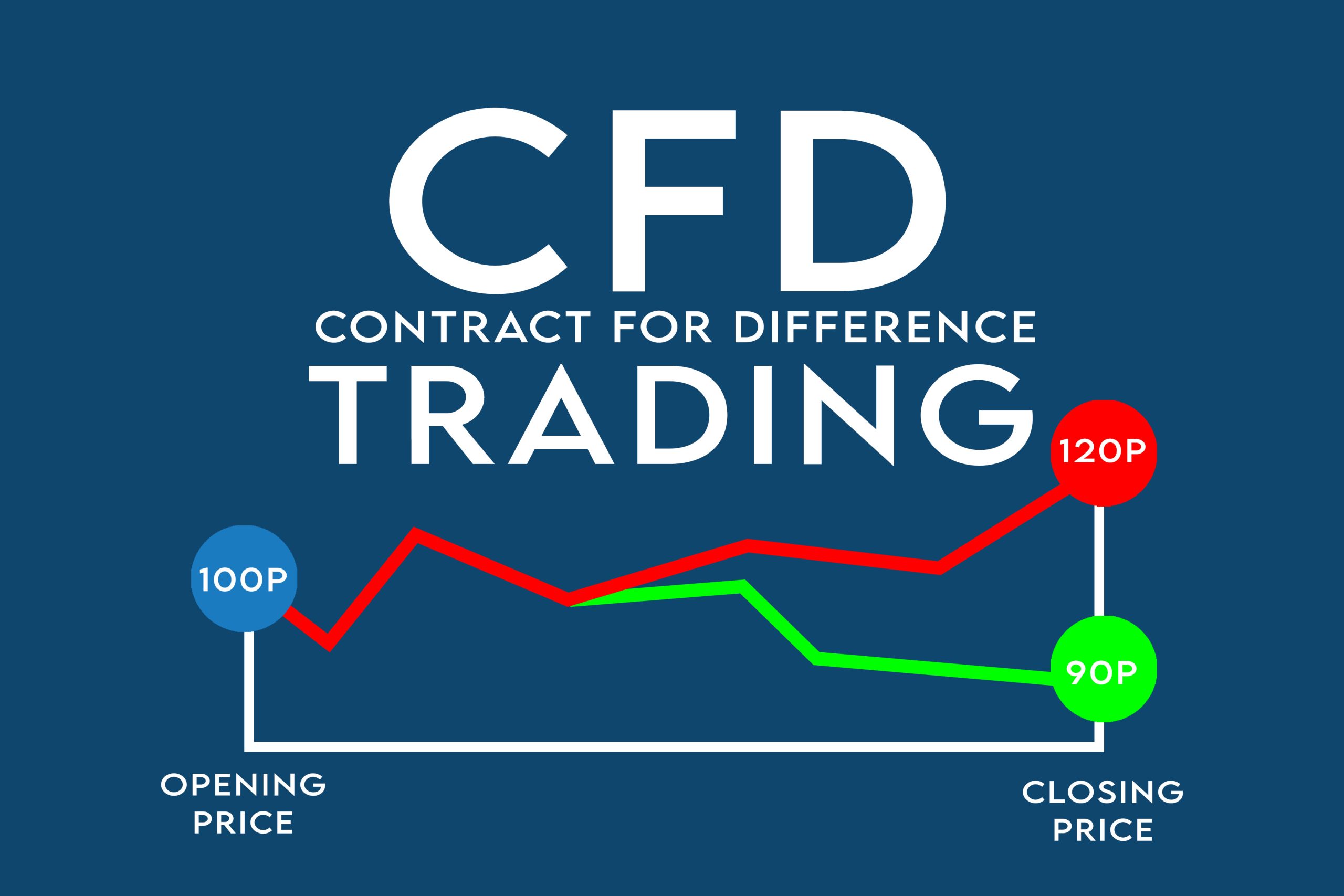

A contract for differences (CFD) is a financial instrument traders use to speculate on prices without owning the underlying asset. When entering into a CFD, an investor and broker agree to exchange the difference between the opening and closing value of the underlying financial product.

Trading using leverage can incur overnight financing fees. These might not be large but still need to be factored into your strategy planning. In fact, these fees are one of the main reasons that CFDs are primarily used for short-term trading. If investing in CFDs over a longer period of time, the fees incurred could negate any potential profits or exacerbate any losses.

When holding long positions overnight, traders typically pay financing charges. These fees represent the cost of the leverage provided by the broker—essentially, the interest on the “borrowed” capital used to control a larger position. The calculation usually follows this formula:

A contract for differences (CFD) is a financial instrument traders use to speculate on prices without owning the underlying asset. When entering into a CFD, an investor and broker agree to exchange the difference between the opening and closing value of the underlying financial product.

Trading using leverage can incur overnight financing fees. These might not be large but still need to be factored into your strategy planning. In fact, these fees are one of the main reasons that CFDs are primarily used for short-term trading. If investing in CFDs over a longer period of time, the fees incurred could negate any potential profits or exacerbate any losses.

Bitcoin cfd trading

This way you can practice any strategy of interest without risking your capital. Once comfortable with your strategy or strategies, you can go in knowledgeably and trade with capital via a live account.

Card transactions are processed by our business partner, Pemax Services Ltd (Registration No. HE 320715), whose registered and business office address issituated at Archiepiskopou Makariou III, 88, Floor 1, 1077, Nicosia, Cyprus.

Trading foreign exchange carries a high level of risk, and may not be suitable for all investors. The high degree of leverage available can magnify profits and as well as losses. You can lose more than your initial deposit. Before trading, please carefully consider the risks and inherent costs and seek independent advice as required. There are also risks associated with online trading including, but not limited to, hardware and/or software failures, and disruptions to communication systems and internet connectivity. Admirals utilises numerous backup systems and procedures to minimise such risks and reduce the duration and severity of any disruptions and failures. Admirals is not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly as a result of failures, disruptions or delays.

Cfd meaning in trading

CFDs are traded online and have gained popularity in recent years due to their flexibility, accessibility, and the ability to trade with leverage. In this article, we will explore in detail what CFD trading is, how it works, and the different types of CFDs available in the market.

Tracking cookies are used to track visitors across websites. The intention is to display ads that are relevant and engaging for the individual user and thereby more valuable for publishers and third party advertisers.

The spread on the bid and ask prices can be significant if the underlying asset experiences extreme volatility or price fluctuations. Paying a large spread on entries and exits prevents profiting from small moves in CFDs, decreasing the number of winning trades and increasing losses.

CFDs are traded via OTC markets in Australia, Belize, Canada, Chile, Denmark, France, Germany, Italy, the Netherlands, New Zealand, Singapore, South Africa, Spain, Sweden, Switzerland, Thailand, and the United Kingdom.

Suppose a week later, the price of Apple shares has increased to $160 per share, and the trader decides to close their position. The trader sells the 100 CFDs back to the broker at the new price of $160 per share, making a profit of $1,000 (i.e., 100 CFDs x ($160 – $150) = $1,000).